You may hear the term portfolio management used in finance and investing contexts, but what does it actually mean? Is it something to do with art? Does it have anything to do with botany? While this might seem like an odd question, let’s explain the process of portfolio management and its various aspects, so you know just what it is and how it works in financial planning and investing contexts.

What Is Portfolio Management

No, portfolio management isn’t just an investment term. Your financial portfolio is just a fancy way to say the things you own. This could be your 401(k), your investments, your insurance or any other assets that are important to you. When it comes to investment management, there are different ways to approach everything from what’s invested in each part of your portfolio to how much risk you want in each area and more.

What it all boils down to is having a plan and sticking with it as much as possible for long-term success. So what does that mean? Let’s break it down. First, when you think about what makes up your entire portfolio, what comes to mind? Are they stocks or bonds? Do you have money invested in real estate through rentals or properties you own yourself?

Are they tangible assets like gold and silver coins, pieces of art or antiques? You might even have some items listed on Etsy! Maybe a portion of your portfolio is even composed of online business ventures like websites or apps.

Regardless of what it looks like, most portfolios have one thing in common: They’re made up mostly (if not entirely) of paper wealth. That means we aren’t talking about actual physical items—we’re talking about numbers on paper; specifically accounts. What’s in those accounts can vary depending on what type of portfolio you have. For example, if you invest in individual stocks and bonds, then your account will show what stock or bond it is along with its value at any given time.

If you’ve got money tied up in a rental property, then those numbers will reflect what your rental income has been over time along with its overall value at any given time. If instead of investing directly into these things individually, however, you’ve opted to invest via mutual funds or ETFs (exchange-traded funds), then your account will list which fund or ETF it is and its value at any given time. The same goes for mutual funds where each share represents a small piece of whatever asset class is inside that fund.

Process of Portfolio Management

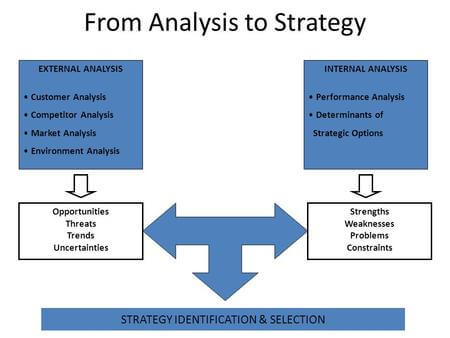

The portfolio management process is complex and multi-faceted. There are several aspects to a successful portfolio, each of which can influence outcomes in both positive and negative ways. In addition, like many financial processes, it involves a lot of intangible factors that make investment results almost impossible to predict with certainty. That being said, here’s what you need to know about how it works A detailed description of what portfolio management entails would be beneficial for anyone who is interested in investing or who has questions about investments.

This information could help potential investors learn more about what they’re getting into before they invest their money, making them better prepared to take on risks if they so choose. It could also help investors who have already made mistakes feel more comfortable asking questions—after all, it’s better to ask and be informed than not ask at all! This type of knowledge will help investors become savvier consumers and may even encourage some people to start investing for themselves instead of putting their money into things like savings accounts or other types of low-risk investments.

As an investor myself, I know firsthand just how important understanding your assets (and liabilities) can be! If someone doesn’t understand what he or she is invested in, then he or she isn’t going to be able to assess his or her own situation realistically. To sum up: explaining its process can help potential investors decide whether they want to invest in stocks, bonds, mutual funds, and other types of securities; it can also help current investors evaluate their performance over time.

If you’re looking for a good way to manage your portfolio without having any prior experience with investing, then doing research online could be extremely helpful! You’ll find lots of resources out there that talk about different methods for managing portfolios as well as tips on how to choose stocks and bonds wisely—but there are also lots of scams out there too.

Various Aspects of Asset Allocation

Asset allocation is a pretty term that simply means how you spread your money among different types of investments. One example is investing in stocks and bonds, but it also includes money market accounts and certificates of deposit (CDs). When determining how to allocate assets, it’s important to consider what type(s) of investor you are—high risk or low risk—and your time horizon for achieving a specific financial goal.

There are many different portfolio management tools to help investors achieve their goals; however, they all generally adhere to three tenets: diversification, asset allocation, and discipline. Diversification helps reduce volatility by spreading out your investment dollars across multiple asset classes. It’s also an excellent way to lower investment fees by spreading them across multiple funds instead of paying one large fee on one fund.

The second tenet, asset allocation, refers to how much of your total investment should be allocated toward each class of investments —stocks, bonds, and cash equivalents such as CDs. For example, if you invest $100 per month in a mutual fund that invests primarily in stocks, then $50 would be considered an equity investment while $50 would be considered a fixed-income investment. The third tenet is perhaps most important: discipline.

Strategic Asset Allocation

In order to explain what is portfolio management, it’s necessary to provide a brief overview of portfolio theory and fundamental asset allocation. The goal of strategic asset allocation is to match risk-reward profiles across multiple investment options so that you can maximize returns while maintaining acceptable levels of risk.

To do so, you must first evaluate your current cash flow needs, future spending habits and risk tolerances before assessing your available resources (which will determine what types of investments are available to you). These initial evaluations should help identify which type(s) of investments will best suit your needs in terms of potential for growth, liquidity, and safety. After identifying these factors, you’ll be able to construct an appropriate asset allocation strategy based on what is portfolio management.

Also Read:

- Unleashing the Expertise: Become a Cyber Security Specialist

- How To Become An Investment Banker In 2023

- What is a Stock SIP and How To Do SIP In Stocks?

- What is NFT and How Does NFT Works – A Detailed Guide

- What is Share Market? How Does the Stock Market Work?

Asset Mix Decision

The asset mix decision refers to choosing a portfolio’s proportions of stocks, bonds, and cash equivalents. As stated earlier, stocks are inherently risky but tend to provide higher returns over time than fixed-income investments such as bonds. Therefore, some investors may be willing to accept more risk in exchange for higher future returns. Conversely, other investors might have shorter investment horizons or less tolerance for risk; therefore they may seek only low-risk (cash) investments.

To achieve an appropriate balance between risk and return, an investor must decide what proportion of his or her portfolio should be invested in each type of security. The process is also known as asset allocation. While many factors can influence how much risk an investor should take on, two of the most important ones are an individual’s financial goals and tolerance for risk. If you want to become wealthy quickly, then you probably shouldn’t invest your entire portfolio in stocks.

On the other hand, if you want your money to last through retirement or college expenses down the road, then it’s probably best not to invest too heavily in bonds either. In general, it’s usually wise to keep at least one year’s worth of living expenses tucked away in cash so that you’re prepared for emergencies—and don’t forget about taxes! When deciding what proportion of your assets will be invested in which securities, it’s important to consider both short-term and long-term goals.

Formulation of portfolio strategy

Portfolio management is an integral part of the investment portfolio and process. Portfolios are different asset classes, like bonds, stocks, and cash that need to be managed by investment managers. Investment managers are professionals who devise various aspects like asset allocation strategy, future income projections, etc., to formulate portfolio strategy. They have a detailed analysis of various processes that helps investors generate the best possible returns on their portfolios with minimum risk in turbulent market condition.

It is basically a process where the fund manager maintains desired levels of return on portfolios at less volatility during adverse financial situations through various portfolio management techniques. Hence, we can say it is an art as well as science at its core aspect that requires a lot many inputs to deliver the best possible outcomes for investors using respective tools and techniques. The main objective of any good portfolio management is how to manage your assets in a way that you earn maximum returns from them.

As far as strategies and techniques used for managing assets are concerned, there are many but the key ones are Asset Allocation Strategy, Sector Analysis Strategy, International Market Strategy, etc. All these require lots of expertise and analytical skills which make up the most important factors in delivering desired results. There should be proper communication channels between all parties involved (investors & Investment Manager) so that they can have a clear understanding of expectations from each other throughout the time period of portfolio management program/portfolio construction phase.

Investment Objectives

Knowing what you’re trying to achieve is a critical part of good portfolio management. You may want to invest for current income or long-term growth, and you may have a particular risk tolerance that affects how aggressive your investment strategy should be. The key is choosing goals that are specific and achievable. This allows you to gauge how your investments are performing on an ongoing basis, as well as understand if there’s more work required toward reaching your objectives.

To do so, it’s a good idea to look at yourself realistically: what returns do you expect? What levels of risk can you tolerate? How much time do you have? A financial advisor can help walk through these questions with an objective view and discuss strategies based on your needs and goals. If you don’t have access to a professional, consider speaking with friends and family who might be able to offer some insight into what they think would work best for you.

It’s also important to remember that your investment objectives will likely change over time—for example, retirement is typically 20 years away when we start saving in our 30s but only 10 years away when we reach 50—so it’s important to review them regularly (at least once per year) and make any necessary adjustments.

Benefits of Portfolio Management

Some people like to focus on what they want to achieve. For example, you may have set a goal for your business or job that has you reaching for a certain amount of money or status. You’re probably looking for ways to get there faster, but not everyone is aware that developing multiple skills and handling various aspects of your work can help you get there sooner than expected. Your portfolio is one such aspect that you can develop while performing other tasks and it’s also what makes many careers so interesting and lucrative in general.

Learning how to handle different parts of your job, as well as other roles within an organization, will allow you more freedom as well as a chance to take advantage of bonuses that come with having multiple skills under your belt. So what is portfolio management? It’s essentially a way to increase your earnings by learning about several different areas of finance and economics. When you learn how each works individually, you can then apply them all together when making decisions about where to invest your time and money.

Having control over several areas allows you to reap larger rewards overall and gain more influence over future projects. It also helps ensure that no matter what happens with anyone’s investment, you’ll still be able to make good use of any extra funds that come your way later on down the road. In short, learning about portfolio management will help ensure that no matter what happens in life or at work, you’ll always be able to keep moving forward toward your goals.

FAQs – Process of Portfolio Management

Portfolio Management refers to the process of managing a collection of investments, such as stocks, bonds, and other financial assets, with the aim of achieving specific financial goals.

The purpose of Portfolio Management is to optimize the risk-return tradeoff by selecting and allocating investments in a way that aligns with an individual’s or organization’s objectives and risk tolerance.

Portfolio Management benefits both individual investors and institutional investors, such as pension funds, endowments, and companies, by helping them achieve their financial objectives and optimize their investment returns.

The key components of Portfolio Management include asset allocation, security selection, risk assessment, and ongoing monitoring and rebalancing of the portfolio.

Security selection refers to the process of choosing specific securities, such as individual stocks or bonds, within each asset class to include in the portfolio.

Asset allocation involves distributing investments across different asset classes, such as stocks, bonds, and cash, based on the investor’s goals, time horizon, and risk tolerance.